Record Sales of "Seeing Machines" from Germany

In 2015, the German machine vision industry achieved record sales of 2 billion euros – a rise of 9 percent compared to the previous year. Sales in the industry have more than doubled in ten years. The reason for the boom: Equipped with machine vision systems, machines and robots are learning to "see". Within the global race towards greater automation, this key technology is not just found in traditional industrial sectors, but is conquering brand new areas too. VDMA forecasts that net sales will continue to rise by 8 percent to 2.2 billion euros in 2016.

"Enabling machines and robots to practically 'see' is revolutionising automation around the globe", says Dr. Horst Heinol-Heikkinen, CEO of ASENTICS and Member of the Board of VDMA Machine Vision. "Demand is being driven by technology developed in Germany, for example, which is making a crucial contribution to quality assurance improvements in manufacturing or diagnostic tools in medicine. This development is reflected with outstanding figures for net sales and growth in the German machine vision industry - and the future prospects are excellent."

In 2015, the industry posted year-on-year sales growth of 13 percent in the German home market alone. Among the global regions, it is exports to the rest of Europe that come out ahead: the share of total sales amounted to 23 percent in 2015. Next comes Asia with 21 percent – with China alone accounting for 9 percent of total sales. Year-on-year growth was an impressive 19 percent there. North America has a similarly high level of growth, boasting an increase of 8 percent compared to the previous year. USA, Canada and Mexico together accounted for 12 percent of the total turnover

Outlook for 2016

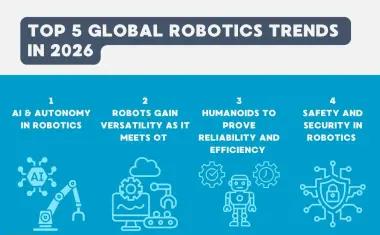

Looking towards the future, the industry anticipates that growth will increase in 2016 by 15 percent in Asia, by 14 percent in America and by 5 percent in Europe. While Asia and America are clearly identified as the engines of growth, there is greater caution about developments in Europe. Relevant risks and opportunities include future developments in the price of raw materials, exchange rates, and last but not least, the effects of political crises.

Machine vision within the various industrial sectors

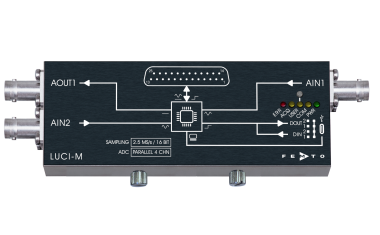

The global trend towards automation in diverse fields and the digitalization of industrial manufacturing (Industry 4.0) constitute drivers for the continued growth of machine vision. Broken down according to sector, the automotive industry remains the strongest customer worldwide, accounting for 22 percent of total revenue. Machine vision revenue in this area rose by 9 percent in 2015. Following a drop in 2011, sales in the sector continue to grow, and in 2015 they surpassed the record levels of 2011. The electrical/electronics industry - including semi-conductors - was the second largest customer, accounting for about 13 percent. Within electronics manufacturing, there was an increase in the demand for machine vision used in the quality assurance of high-grade products. In the area of screen and monitor production (TFT/FPD industry), there is a new generation of displays coming onto the market, demanding higher resolution quality and better data processing.

Industry 4.0

Companies are creating intelligent factories of the future around the world, and machine vision is their cornerstone. The reason: No other component in the production process is able, with the aid of the "vision capability", to collect so much information and deliver it to systems in the way that machine vision can. Machines that "see" and "understand" are not only able to recognise if a part is good or bad, for they can also proceed to handle the situation intelligently. Within networked "smart factories", this data pool will be used to enable logistics assignments to be issued autonomously, repair jobs to be dispatched automatically, and human assistance requisitioned when necessary. Data analyses also mean that machine vision can detect levels of wear or manage maintenance cycles. Machine vision is therefore both a trailblazer and the key technology for meeting the challenges of Industry 4.0.

Non-industrial applications with growth opportunities

Non-industrial applications are making a significant contribution to the increase in sales in German-made machine vision, accounting for an average growth rate of 16 percent per year (2011-2015). Demand in transport technology, medical technology and logistics is actually growing faster than in industrial manufacturing. Large potential is also being identified in the agricultural sector. Overall, the prospects for innovation and growth are greater in the non-industrial sectors.