Mixed results in the global manufacturing industry at the end of 2024

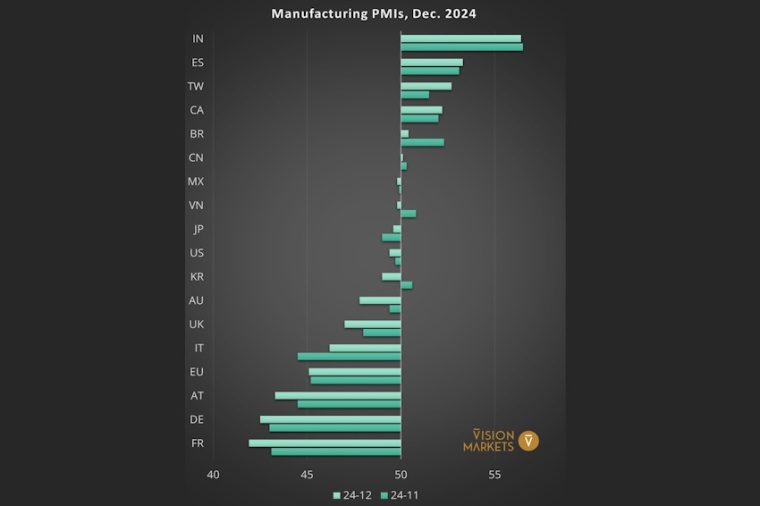

The latest Manufacturing PMI report for December shows a mix of resilience and challenges in key global economies.

In North America, the US saw a marginal decline after experiencing a steep increase in the M-PMI since September. With Trump's second term in office and unforeseen policy changes, manufacturers' sentiment is retreating from the 50-point line. Canada continues to show steady growth and signals a stable expansion. A brightening of the economic climate in Canada is expected following the resignation of Prime Minister Trudeau. Mexico records a slight decline of 0.1 points and remains close to the neutral line. Brazil is included in the monitoring for the first time and continues to show growth above 50 despite a significant decline of 1.9 points.

These trends underscore the divergent developments among global economies, with emerging markets such as India and Taiwan leading the recovery while developed markets face ongoing challenges.

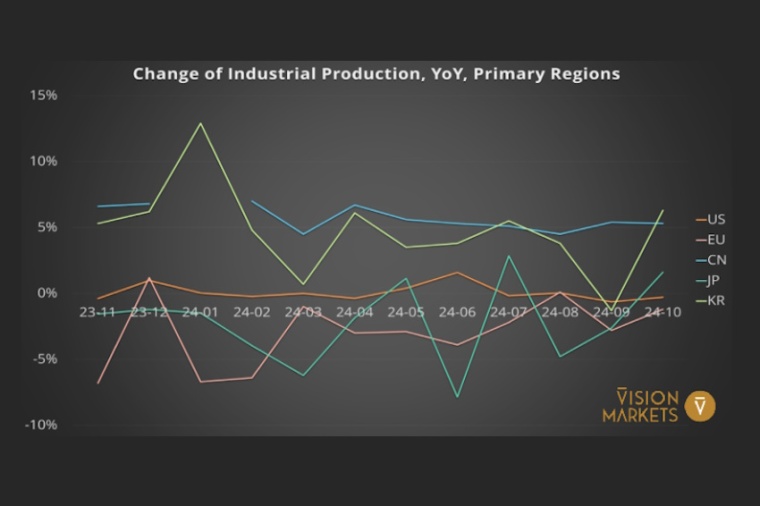

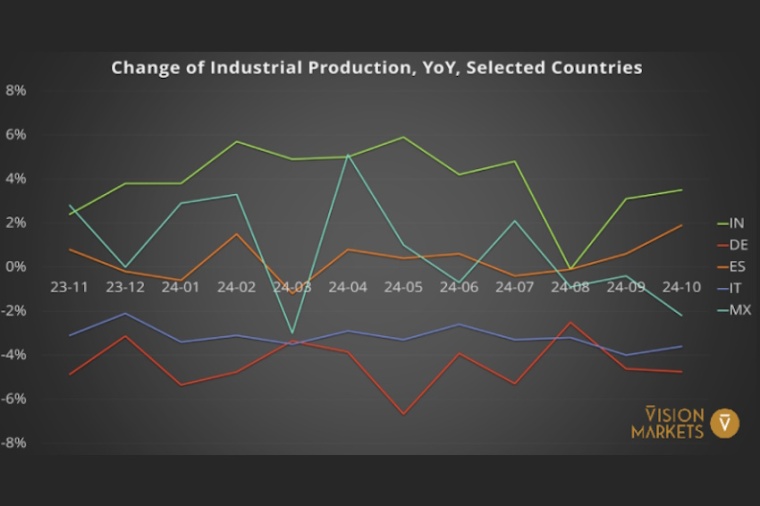

The annual production data (see Figures 2 and 3) show mixed results. The US is recovering slightly but remains negative, while the EU is slowing its decline. Japan is returning to positive territory, and Korea is showing significant growth after previous difficulties. China remains robust above 5 percent growth. India continues to show strong growth, while Mexico is experiencing deeper contractions. Germany tightens its contraction slightly, while Spain continues its recovery and Italy shows some stabilization.

Structural challenges in developed markets such as the EU and Japan remain a key concern, although Japan has returned to positive growth and the decline in the EU has become more moderate. The impact of Trump 2.0 on the US manufacturing industry is still uncertain.

In Asia, South Korea sees a steep decline of 1.6 points and falls into contraction territory. Japan recovers slightly to 49.6, while Taiwan shows the strongest rebound in the region with an increase of 1.2 points. China plans to issue Chinese ID cards to Taiwanese citizens, which could affect the economic situation on the island. Vietnam slips into contraction, signaling challenges after months of stability.

In Europe, Spain continues to exceed expectations with a slight improvement. Germany and Austria show modest improvements but remain deep in contraction territory. France struggles with increasing economic challenges and political unrest. Italy shows less pessimistic sentiment with a notable improvement of 1.7 points.

Company

Vision Markets GmbHZiegelei-Ring 5

82194 Gröbenzell

Germany

most read

Basler AG: Change in the Management Board and new CTO position

Long-time CEO Dr. Dietmar Ley will leave the Executive Board at the end of 2025

Machine Safety 2026: The Five Most Important Trends for Eutomation Engineers

Digitalization and automation continue to drive mechanical engineering forward - and with them, the requirements for functional safety and cyber security are increasing. For automation engineers, this means that machine safety is becoming a holistic concept.

MVTec Innovation Day 2026: Exchange and insights into machine vision

This event, now in its eighth year, offers the machine vision community a platform for networking and professional exchange.

5 robotics trends for 2026

The International Federation of Robotics reports on the five most important trends for the robotics industry in 2026.