M&A Trends and Purchase Prices in the Vison Industry

09.04.2019 -

In the prospering vision industry, M&A transactions are becoming more and more popular. Yet, it takes more than just money to ensure such transactions are successful. Munich-based Arthos Corporate Finance is giving insight into those market developments.

The vision industry is fascinating – not just in terms of technology trends and new product offerings, but also with regards to completed M&A transactions, and we are expecting more to come. Prices for vision companies have been increasing over the last couple of years and therefore we are often asked by investors how attractive companies can be convinced to listen to takeover offers and how investors can avoid overpaying in this market.

Growing Attractiveness

It is well known that the vision industry has become more attractive in recent years because, on the one hand, the industry has left its niche existence behind and, on the other, because annual growth rates of more than ten percent have been recorded in many vision market segments. Due to constantly improving technologies with availability of cheaper sensors, software and processors new applications are opening up, many in the field of Industry 4.0, but also in segments such as medical, logistics, agriculture or even mobility of the future.

This growing attractiveness of the vision industry has attracted many new investors who historically have not, or only to a limited extent, been active in the vision industry. This has created additional options for mid-sized companies that are considering a potential sale that were not previously available. We see this trend for the following types of investors:

- Financial sponsors

- Publicly listed industry holdings

- Strategic investors

Financial investors with new type of transactions

In November 2018, the financial sponsor Ambienta made headlines with the sale of the Lakesight Group to the TKH Group NV by attaining a purchase price of Euro 140 million. This result was achieved through the implementation of a buy & build strategy, i.e. the acquisition and bundling of several companies. It is interesting, above all, that with Tattile and Mikrotron companies were initially acquired which, due to their economic situation or their lack of fit with strategic investors, had not found a buyer for a long time. Another example is the acquisition of Stemmer Imaging AG by Primepulse SE (formerly Alko AG), followed by an initial public offering. Almost always, financial investors are actively influencing business development and introducing measures to increase profitability. In addition, the management structure of the acquired companies is often significantly changed. The two transactions mentioned above show impressively that the support of financial sponsors enabled new type of transactions that previously did not take place in the vision industry.

Listed industry holdings increasingly invest in vision companies

The publicly listed companies Ametek Inc., Konica Minolta Holdings K.K. and Halma plc are examples of listed industry holdings investing in very profitable and strongly growing companies in technological industries. The business model and the management structure of the acquired companies are not or only slightly changed – the acquired companies retain a high level of independence because they are already economically very successful when acquired. Historically, these listed industry holdings have purchased in related industries such as the electronic equipment or photonics sector. However, because of the growing attractiveness of the vision industry, they are now also investing in this promising sector.

Additional strategic investors are showing interest

Last but not least, during recent years many companies invested in the vision industry for strategic reasons that were not present in this segment before. Strategic investors are companies that integrate acquired companies into their existing business in order to achieve business synergies. Examples include Balluff GmbH, Hexagon AB and Flir Systems Inc., which were previously players in automation, metrology and infrared technology, respectively. From the point of view of these strategic investors, machine vision competencies and technologies became key to their own future business development and thus the integration of the acquired companies is the main driver for strategic investors.

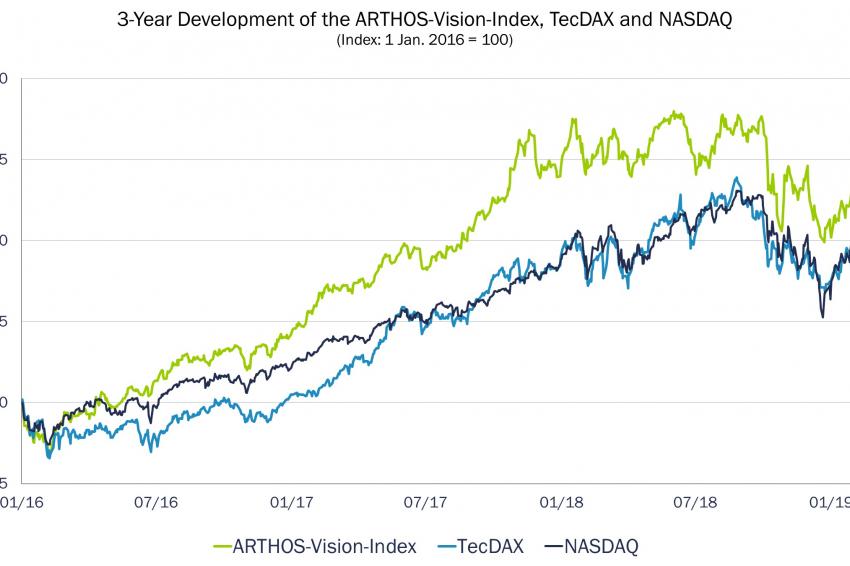

Vision companies outperform other technology companies at the stock exchanges

The high attractiveness of the vision industry is also reflected in the good performance of listed vision companies. Comparing the ARTHOS-Vision-Index – which includes the most important listed vision companies worldwide (e.g. Cognex, Teledyne, TKH Group) – with the performance of technology market indices, shows that the TecDAX as well as the NASDAQ were outperformed over the past three years. Furthermore, the recent recovery of vision stocks is due to growth expectations that are once again above those of other technology companies.

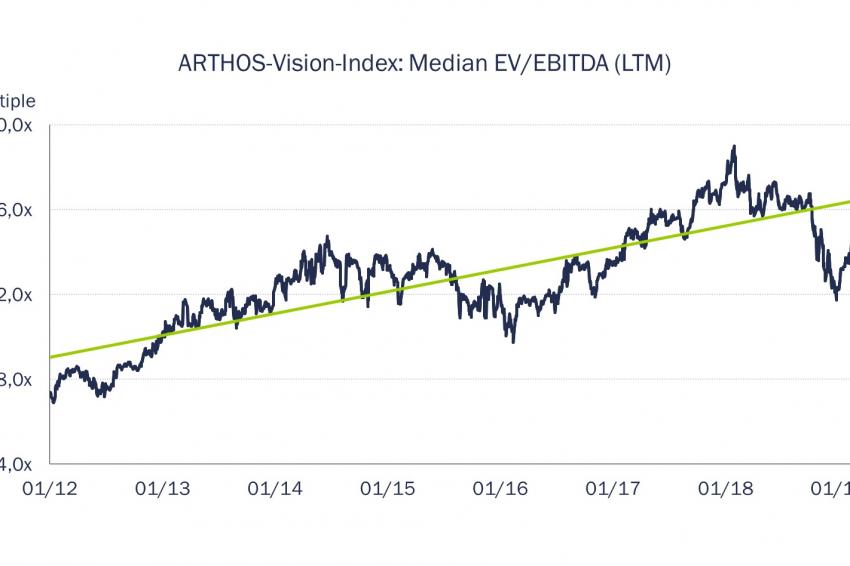

Vision companies continue to have an attractive valuation

A common valuation multiple for listed companies is the enterprise value (EV) divided by the EBITDA of the last 12 months (EV / EBITDA LTM). Since 2012 the median EBITDA multiples of the ARTHOS-Vision-Index increased from below 8 to a peak of 18; after the recent market correction, at the end of 2018 the median came down to 12, which was still approx. 50% above its 2012 value. However, thanks to the recent recovery of vision stocks, the median rose back up to a multiple of around 14.5 in just six weeks.

Even though prices at the stock exchange fluctuate more than purchase prices of small and medium-sized enterprises (SMEs), the long-term trends are fundamentally transferable, because SMEs operate in the same industry environment and the individual valuation of listed companies also affects their capability to pay higher or lower purchase prices for SMEs. However, it should be noted that M&A purchase prices of SMEs usually trade at a discount rate to stock market valuations e due to their smaller size and the illiquidity of their company shares. According to our experience, during the past three years an average EBITDA multiple of about 10 was paid for vision SMEs with an annual growth rate and with an EBITDA margin of around 10 percent. In comparison, EBITDA multiples of around 8 are paid for SMEs in the electronics industry, which is roughly equivalent to the prices paid for vision SMEs three to five years ago. This shows that the valuation trend of the stock market for vision companies also had a positive effect on purchase prices for SMEs.

Despite the current correction in stock market valuations, we do not expect prices for SMEs in the vision industry to decrease considerably as the dynamic demand for vision products and services driven by applications for industry 4.0 or , mobility of the future and others will continue to keep the interest of investors in vision SMEs high.

It Takes More Than Just Money to Acquire a Vision Company

It is also interesting to observe that interested parties from various buyer groups often submit proposals with similar purchase prices in bidding processes. That means that the decision process between different offers is less a result of differences in the purchase price, and much more driven by the plans of the investors for the acquired company and what future role they offer the former owner.

In transactions with financial investors, normally former owners are offered the option to reinvest in a parent holding company at the time of the sale of their company in order to be able to participate economically in future development. In addition, often a non-executive director position is part of the package. Listed industry holdings, which in many cases are domiciled overseas, as well as many strategic investors often pay part of the purchase price as an earn-out, i.e. depending on the future economic success of the acquired company, sometimes even years after the purchase. From the seller’s point of view, strategic investors can often offer the most promising packages, as business synergies can sometimes result in significant additional revenues for the acquiror as well as the acquisition target. However, the reality shows that some acquirors execute integrations better than others and adaptability to the interests of the seller, in particular, is sometimes limited.

Therefore, during the purchasing process it is not about developing a long target list and then approaching many to finally succeed with at least one, but more about offering interesting roles for the owner and the company they built up. Those acquirors who make people curious when approached and offer business concepts tailored to the seller’s interests tend to be most successful. To avoid overpaying, focus on what is really needed, e.g. what is more important: excellent products or the sales channel? The right M&A strategy combined with a properly tailored approach certainly takes much more time and effort, but in return leads to a much higher success rate and ROI.

Contact

ARTHOS Corporate Finance GmbH

Knöbelstraße 28

80538 München

+49 89 2429 4350

+49 89 2429 5355