AM industry confident in a tense economic situation

Increasing reluctance to invest despite expected growth within the industry.

“In the current very difficult market environment across all sectors, our member companies are proving surprisingly robust,” explains Markus Heering, managing director of the VDMA’s Additive Manufacturing Working Group. “Despite the tense situation, only a third of companies reported declining sales in the fall survey.”

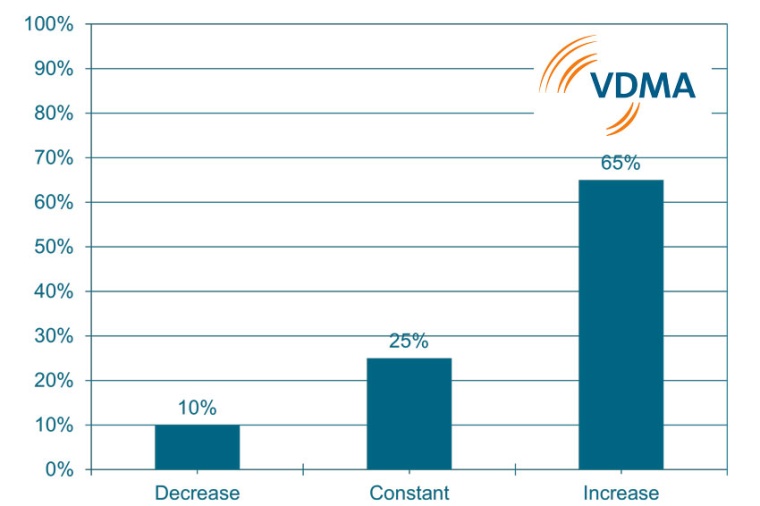

There are now also signs of a trend reversal. "Looking ahead to the next 24 months, almost 70 % of respondents expect a return to growth in both the domestic market and the export business," reports Dr Heering. The EU-27 is the most important export region for almost three quarters of member companies, followed by the USA (55 %) and European non-EU countries (31 %). China and other Asian countries, on the other hand, are only among the top sales markets for 9 % of respondents, respectively. “Since the pandemic, business in Asia has clearly lost momentum,” says Heering. The originally high expectations for these markets have not been fulfilled. Instead, competition from China is increasing. More than a third of respondents see their most relevant competitors there. Measured against 65 % who see themselves primarily competing with German AM providers and 44 % who feel competitive pressure primarily from the USA, this is only the third-highest figure. However, there are signs that the AM industry in China is maturing and is now also becoming visible in Europe.

In view of the difficult market environment, the member companies of the VDMA's Additive Manufacturing Working Group are currently holding back on investments. In the first half of the year, only 29 % intend to increase their investments. This figure rises to 45% for the outlook for the year as a whole. “We also interpret this as a sign that companies are generally confident about the future,” explains Heering. For 62 % of respondents, this confidence stems from new AM applications and for 40 % from their entry into new markets. More than a fifth of companies also hope that the expansion of their production capacity and increased marketing and R&D activities will provide positive impetus in the current year.

“Our working group brings together a wide variety of players who offer products and services along the additive process and value chains,” says Heering. Despite the heterogeneous composition – providers of AM systems and their suppliers as well as post-processing specialists are represented alongside AM service providers and manufacturers of AM components for in-house use, specialized consultancies, research institutes as well as software and material providers – there is broad agreement on where the AM industry needs to improve.

“It’s about finding new applications in which AM offers real added value for companies that use it. In order to increase market acceptance, we also need to continue working on the stability and reproducibility of AM processes and on the cost level,” summarizes Heering. Even if many processes are maturing faster than originally expected, technological development in all areas of the process chain remains the central task of the young industry.