Manufacturing industry could recover from 2025

27.11.2024 - A study has predicted the recovery of the manufacturing industry for 2025, but the slowdown is “tough”

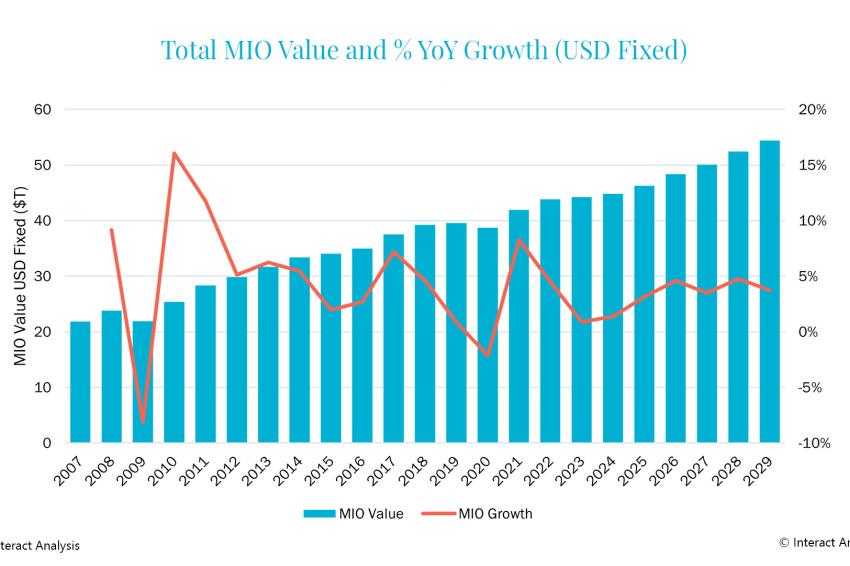

Manufacturing will recover in 2025, but the latest forecast from Interact Analysis has weakened for most regions as the slowdown appears to be more “prolonged” than expected and could extend into next year. This has led to a weaker recovery in 2025 than previously predicted, but output is expected to return to normal by 2026, and the market research specialist does not foresee any major problems for the sector until the end of the decade.

According to the latest Interact Analysis Manufacturing Industry Output (MIO) Tracker, 2024 has proven particularly difficult for many industries, including traditional market sectors such as commercial vehicles, pulp and paper, textiles, and those associated with construction.

Semiconductor production will recover strongly in 2024

An expected strong recovery in the semiconductor sector in 2024 will benefit the economies of the APAC region, such as South Korea, Singapore and Taiwan, which suffered in 2023 from low demand in a key industry.

In other sectors, many machine OEMs are outperforming their industrial automation component suppliers as demand for both has slowed. The industry appears to be going through a period of destocking, with customers reluctant to invest in machine upgrades while interest rates remain high, and many of the sectors that require machines with drives, motors, and gearmotors are currently in the doldrums. The growth in manufacturing output for 2025 has been revised as the downturn continues.

Europe and America bear the brunt of the downturn

The regions most affected by the downturn are Europe and, to a lesser extent, America; some key regions in the APAC region show stronger signs of continued growth, albeit at a slower rate than in recent years.

In Europe, the automotive sector shows the strongest CAGR of any sector over the next five years at 4.6%, despite its recent difficulties, while in APAC the semiconductor and components industry performs best and the transportation sectors in the Americas grow due to infrastructure investment across the region.

Commenting on the latest MIO Tracker, Jack Loughney, Senior Data Analyst at Interact Analysis, says: “The machinery sector is in a difficult position. Demand for machinery is much more volatile than overall demand for manufactured goods, and in every downturn, machinery has underperformed the general economy. As the manufacturing sectors emerge from their own downturns, we expect machinery to rebound strongly in most cases, with equipment such as packaging and semiconductor machinery expected to perform well.”

Contact

Interact Analysis Group Holdings Ltd.

Riverside House, Station Road

NN9 5QF Irthlingborough

United Kingdom

+44 1604 272 367