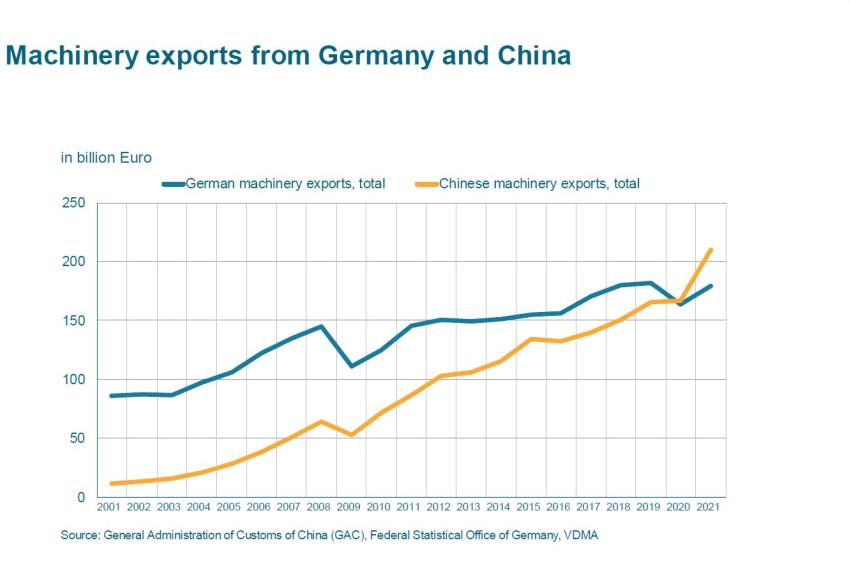

Machinery exports: China extends lead over Germany

Chinese exports to the EU are also growing faster than German exports

China retains the title of world mechanical engineering export champion in 2021 with exports worth 210.1 billion euros. The lead over German mechanical engineering, first achieved in 2020, is actually growing because China's exports have increased by a good 26 percent.

"However, it is important to bear in mind that a significant proportion of Chinese machinery exports come from manufacturing facilities operated by foreign companies in China or in which they have a stake in the form of joint ventures," explains VDMA chief economist Dr. Ralph Wiechers.

Nevertheless, he is concerned: "With an increase of 32 percent, Chinese machinery exports to the EU excluding Germany grew significantly faster than German machinery exports to EU partner countries (plus 11 percent). Thus, China increased its market share in the EU last year as well."

Foreign companies important for China's mechanical engineering sector

Foreign mechanical engineering companies accounted for around 27 percent of China's machinery exports in 2017. Joint ventures were also responsible for nearly 14 percent of machinery exports. Thus, companies with foreign participation accounted for 41 percent of exports.

"More up-to-date export data by ownership structure is not available. However, at least one in three machines from China is still likely to come from companies with foreign ownership," says Wiechers. "This also includes engagements of German companies. How many these are, however, cannot be quantified with the available data."

A look at the sectors of the mechanical engineering industry, however, shows that export successes not of purely Chinese origin vary greatly in some cases by subsector. For example, foreign companies still accounted for more than 80 percent of China's industrial robot exports in 2017.

EU and USA equally relevant for China

The analysis of China's most recent export data provides results for the regional positioning of Chinese machinery exporters: for example, the three sales markets of the EU, ASEAN and North America are of roughly equal importance to them.

Machinery worth 35 billion euros was exported to all three regions in 2021. By way of comparison, machinery worth just under 71 billion euros was exported from Germany to the EU partner countries last year, which corresponds to a share of just under 44 percent of total German machinery exports.

This shows the enormous importance of the domestic European sales market for machinery exporters from Germany. Machinery worth 19.8 billion euros was shipped to North America and only 4.4 billion euros worth of machinery to ASEAN.

The top 5 markets for machinery exports from China are the United States (up 22 percent to 31.1 billion euros), Japan (up 22 percent to 11.1 billion euros), Vietnam (up 30 percent to 10.5 billion euros), India (up 39 percent to 8.9 billion euros) and Germany (up 40 percent to 8.5 billion euros).

Chinese machinery exports to Russia soar

Machinery exports from China to Russia jumped 55 percent to 8.0 billion euros in 2021. To Ukraine, manufacturers from China supplied machinery worth 1.1 billion euros (up 44 percent).

Machinery exports from Germany to Russia increased by 3.8 percent to 5.5 billion euros last year, with German machinery worth 1.1 billion delivered to Ukraine.

"China is now by far the number one foreign machinery supplier in Russia due to the high gains. However, in terms of their respective total exports, the combined sales market importance of Russia and Ukraine for China and Germany is at a similar, manageable level, at less than 5 percent each," Wiechers analyzes.

Sanctions against Russia likely to severely restrict machinery exports

However, as a result of the Russian invasion of Ukraine and the far-reaching reciprocal sanctions imposed by Europe and Russia, the shares here are likely to shift noticeably in the foreseeable future. "We have to assume that even if peace is concluded quickly, sanctions will remain in place and European machinery and plant manufacturers will have a harder time in this market than their Chinese competitors," says the VDMA chief economist.

Contact

VDMA Verband Deutscher Maschinen- und Anlagenbauer e.V.

Lyoner Str. 18

60528 Frankfurt

Germany

+49 69 6603 0

+49 69 6603 1511